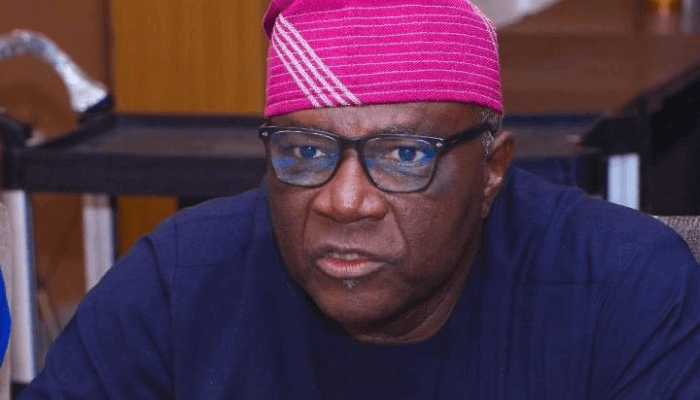

The Special Adviser to the President on Information and Strategy, Bayo Onanuga, has faulted critics raising objections over the tax laws.

Speaking to Punch, he rejected calls for the suspension, insisting the legislation was “unstoppable” and would take effect from January 1, 2026.

Onanuga described the reforms as “revolutionary,” arguing that the new regime would enhance tax revenue for the benefit of Nigerians, while dismissing calls for suspension as inconsistent with “right-thinking Nigerians

He said, “The law has been passed by the National Assembly. It has been endorsed by the President. And some people are just waking up when they should have made known their objections a long time ago.

“The law is unstoppable. By January 1, 2026 by the grace of God, the implementation will begin. And there is nothing to fear. This development will harmonise most of our multiple taxes and it also excludes the low-income workers from being taxed.

“But some people are saying that it should be implemented? You can see that they are not on the same page with right-thinking Nigerians.

“It is a revolutionary law that will enhance our tax revenue with the benefits of all Nigerians. For them to say we should not implement, it’s too late to raise objection. The law as it stands today is unstoppable.

“It is already being implemented anyways.”

President Tinubu recently signed four major tax reform bills into law, marking what the government has described as the most significant overhaul of Nigeria’s tax system in decades.

The laws include the Nigeria Tax Act, the Nigeria Tax Administration Act, the Nigeria Revenue Service (Establishment) Act, and the Joint Revenue Board (Establishment) Act, all of which operate under a single authority, the Nigeria Revenue Service.+See more details

The laws are scheduled to take effect on January 1, 2026, following a six-month transition period for public education and system alignment.