The Nigeria Revenue Service (NRS) has dismissed reports suggesting that Value Added Tax (VAT) has been newly introduced on banking services, fees, commissions and electronic money transfers, describing such claims as misleading and inaccurate,LeadNaija Reports.

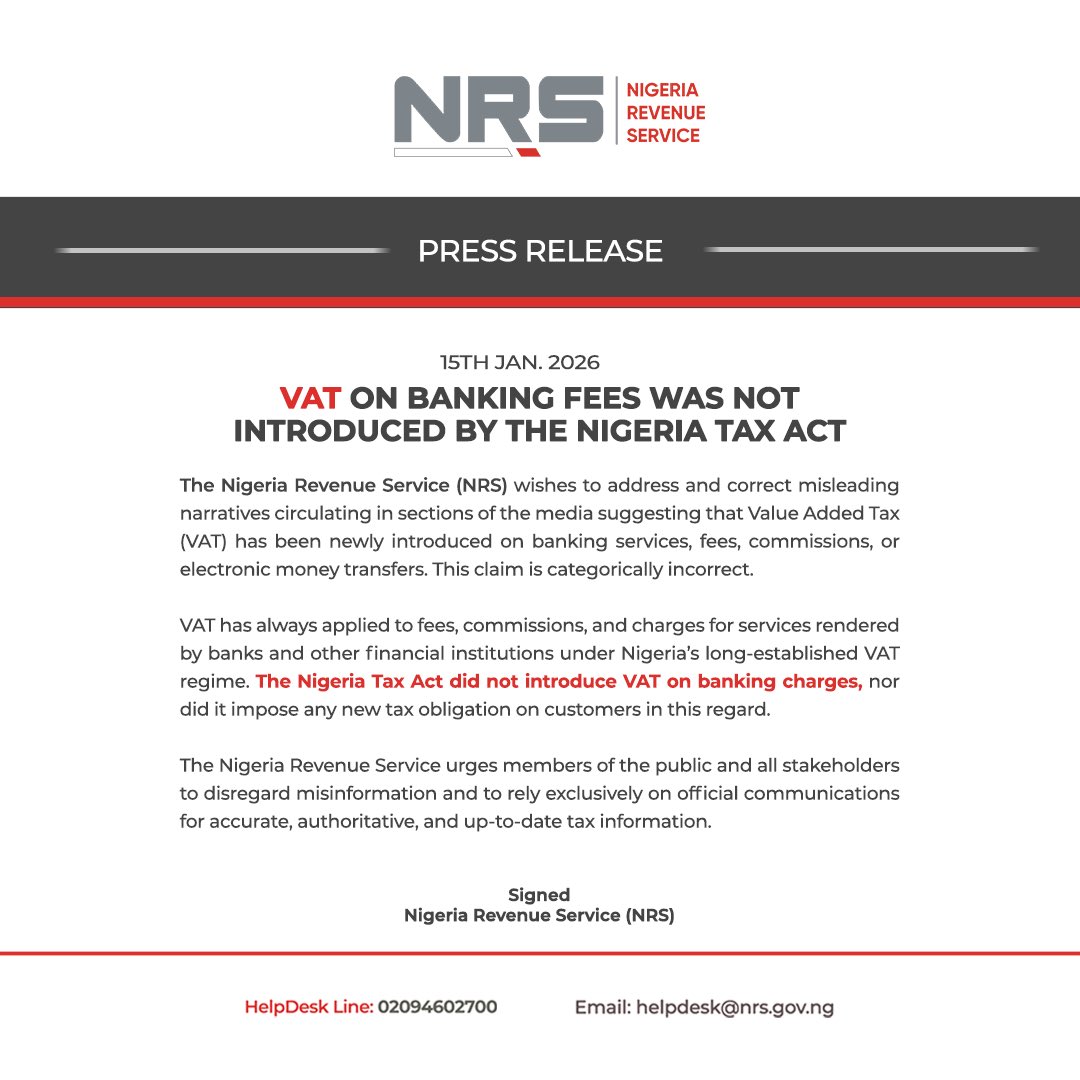

In a press release dated January 15, 2026, the NRS clarified that VAT has always applied to fees, commissions and charges for services rendered by banks and other financial institutions under Nigeria’s existing VAT framework.+See more details

According to the agency, the recently enacted Nigeria Tax Act did not introduce VAT on banking charges, nor did it impose any fresh tax obligations on customers in relation to financial transactions.

“The claim that VAT on banking services is new is categorically incorrect,” the NRS stated, stressing that the applicable VAT regime has been in place long before the new tax legislation.

The revenue authority urged the public and stakeholders to disregard what it described as misinformation circulating in some sections of the media, advising Nigerians to rely only on official government communications for accurate and up-to-date tax information.

The clarification comes amid growing public concerns and debates over tax reforms and banking charges following the passage of the Nigeria Tax Act, with the NRS insisting that no additional VAT burden has been placed on bank customers.+load full details

Read Official Statement Below: