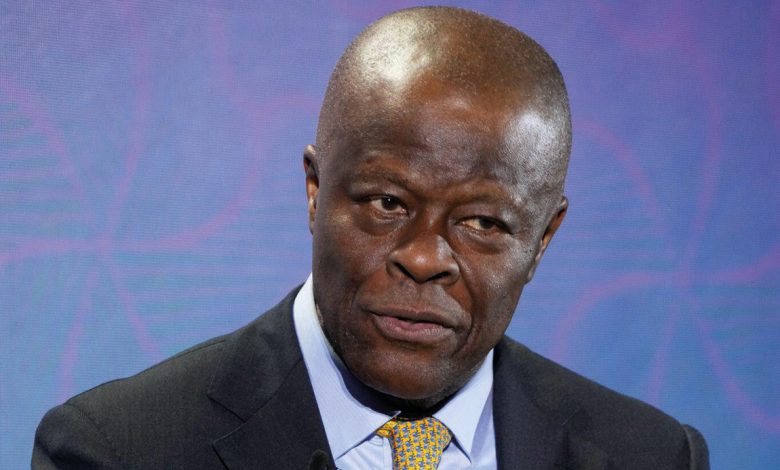

The Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, has confirmed that the federal government would impose 15 percent Value Added Tax (VAT) on luxury goods, adding that total subsidy removal became effective last month.

Fielding investors’ questions at a meeting on the sidelines of the on-going IMF/World bank Annual Meetings in Washington DC, he said that a bill before the National Assembly would bring about a situation where rich Nigerians would pay VAT rate that would increase over time to 15 percent.

He clarified, however, that the poor and vulnerable will pay less or zero VAT on essential goods.

According to him, the list of such essential goods that would attract zero VAT would be made available to the public in due course.

His words: “In terms of VAT, the commitment of President Bola Tinubu is that while implementing difficult and wide-ranging but necessary reforms, the poorest and most vulnerable will be protected.

“And in the case of VAT, it is a very efficient tax for reasons well-known but it is also a tax that is targeted. So the bills going through the National Assembly in terms of VAT will raise VAT for the wealthy on luxury goods while at the same time seeking to exempt or seek a zero rate for the essentials and for what the poor and the average persons will purchase.

“Those bills will single items for zero rate of VAT while hitting luxuries with a higher rate of VAT.”

Edun was optimistic that the oil sector was set to increase the accretion of foreign exchange (FX) into the market, as according to him, oil production was being ramped up with better security in the oil-producing areas and new investments, especially those announced by Total and ExxonMobil.

He also said that total removal of fuel subsidy became effective in September 2024.

“Savings from fuel subsidy savings would become more impactful on the economy going forward, the complete fuel subsidy became effective only last month,” he stated.

Source: (Vanguard)