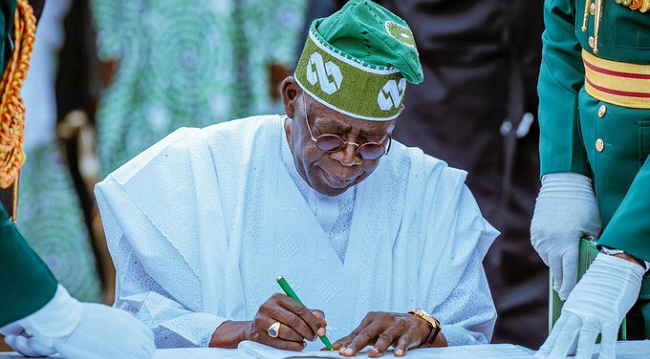

The recent request for borrowing of $2.2bn by President Bola Ahmed Tinubu has reignited concerns about Nigeria’s unsustainable debt trajectory. At a time when the economy is battling with high inflation, unemployment, and dwindling foreign reserves, many Nigerians are wondering when this cycle of endless borrowing will end?..CLICK TO READ THE FULL NEWS HERE▶▶

A History Of Borrowing With Little To Show

Successive administrations have justified borrowing as a necessity for financing critical infrastructure, but the tangible benefits remain questionable. Between 2015 and 2023, Nigeria’s debt stock soared from $63bn to over $115bn. Yet, for all the borrowed funds, the promised economic transformation has largely failed to materialize:

Infrastructure Deficits: Projects such as the Second Niger Bridge, railways, and highways have either been abandoned, delayed, or completed at inflated costs without corresponding economic impact.

Social Programmes: Initiatives like fuel subsidy removal savings and poverty alleviation schemes have been poorly managed, leaving millions in deeper poverty.

Corruption:

According to Transparency International, Nigeria loses approximately $18bn annually to corruption. Borrowed funds often disappear into the hands of political elites and contractors, leaving Nigerians to bear the burden of repayment.

Where does Tinubu’s borrowing leave the economy?

It must be admitted that President Tinubu inherited an economy already on its knees. Inflation currently stands at over 30 per cent, the naira continues to weaken, and foreign direct investment has declined. While some Nigerians argue that borrowing is a necessary evil for fiscal stability and development, the question is whether incumbent administration is addressing the root causes of the economic malaise or deepening it.

Economic Policies vs. Reality:

President Tinubu’s policies, such as subsidy removal and currency reforms, have led to short-term hardships without a clear cut long-term relief. Borrowing $2.2bn amidst these challenges suggests a lack of sustainable economic planning.

Debt as a Liability: Borrowed funds must eventually be repaid, often at high interest rates. With 96% of Nigeria’s revenue already spent on servicing debts, the new loan will worsen the debt-revenue ratio, leaving little for development.

State Capture:

Former President Olusegun Obasanjo aptly described Nigeria’s situation as “state capture,” where a few elites control state resources for personal gain. In such an environment, borrowed money becomes a tool for entrenching corruption rather than fostering growth.

The Role of the National Assembly: A rubber stamp institution?

Nigeria’s National Assembly has come under fire for its perceived complicity in approving loans without rigorous oversight. This “rubber stamp” approach undermines the principles of accountability and fiscal prudence.

By approving every loan request without demanding comprehensive project plans or conducting impact assessments, the legislature is failing its constitutional duty to protect the nation’s future. The youths, who constitute over 70 per cent of the population, are watching—and the consequences of continued negligence could be catastrophic for the political class.

The wrath of the youths: A warning to leaders

The frustration among Nigeria’s youth is palpable. With high unemployment, rising living costs, and limited opportunities, the government’s borrowing spree feels like a betrayal of their future. Social media movements, protests, and political engagement are growing as young Nigerians demand accountability.

If the National Assembly and the Tinubu administration fail to address these concerns, they risk igniting a generational revolt that could reshape the country’s political landscape.

Conclusion: Stop the madness

This borrowing spree by the Nigerian government is a gamble the country can no longer afford. The administration must focus on cutting waste, combating corruption, and fostering economic growth through innovation and investment, rather than mortgaging the nation’s future.

The National Assembly must shed its “rubber stamp” image and prioritize the interests of Nigerians. As the country teeters on the brink of economic collapse, leadership must take bold, transparent steps to restore trust and build a sustainable future—or face the wrath of an angry and determined youth population…..CLICK TO READ THE FULL NEWS HERE▶▶