Samson Ezugworie, Seplat Energy CEO, says the company is prioritising the revival of existing wells in its SEPNU asset.

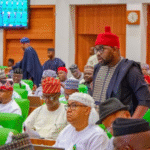

At Seplat Energy’s 12th annual general meeting on Wednesday, Mr Ezugworie noted plans to invest in further drilling campaigns to boost performance and increase production output. He added that the company is increasing gas volumes through ongoing activities at the Sapele Integrated Gas Plant.

Mr Ezugworie outlined Seplat’s strategy to maximise production potential, aiming to drive business growth and unlock further opportunities.

“Our focus remains on reviving existing wells, increasing drilling campaigns and boosting gas volumes through SIGP,” Mr Ezugworie said.

He said Seplat’s legacy business delivered an average working interest production of 48,618 boepd, aided by various positive factors. These included strong results from 2024 drilling, new gas output from SIGP, and improved Oben gas production after maintenance.

Mr Ezugworie explained that operational gains also came from sustained efficiency on the Trans Niger Pipeline.

“Our 2025 guidance targets 120,000–140,000 boepd, with Q1 already showing 131,561 boepd—aligned with our forecast,” he said.

Seplat CEO Roger Brown said the company was committed to enhancing Nigeria’s energy landscape while supporting healthcare, education and empowerment.

He highlighted Seplat’s milestone of conducting 100,000 eye tests under the ‘Eye Can See’ programme.

“It also aligns with SDG 13.3 — building knowledge and capacity to combat climate change,” Mr Brown added.

Eleanor Adaralegbe, the chief financial officer, said 2024 financials were buoyed by increased production, particularly SEPNU’s 19-day contribution.

Total revenue reached N1.652 trillion, reflecting strong output despite slightly lower oil prices.

Adjusted EBITDA was N796 billion, including $99 million from SEPNU, a 20.3 per cent rise in 2023.

“After $235 million in taxes, net profit stood at $145 million. We generated $383 million cash from operations,” Ms Adaralegbe said.

She explained that the net debt rose to $898 million due to the acquisition of MPNU.

Seplat retained strong credit ratings and successfully refinanced its $650 million bond in March 2025.