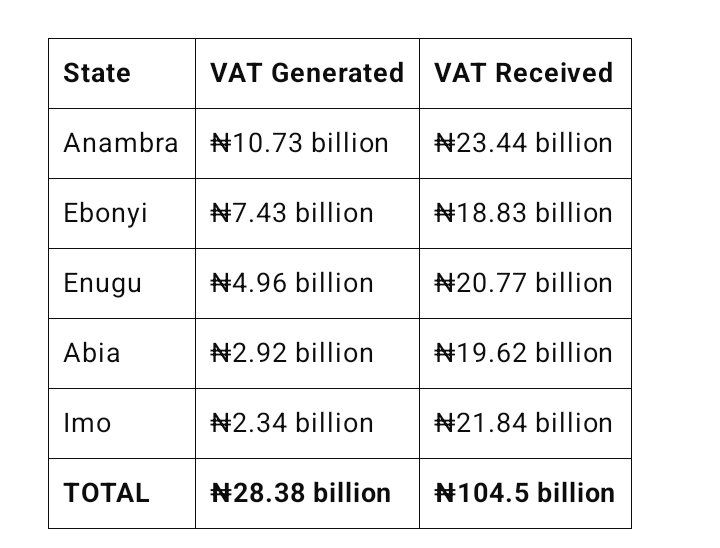

New figures released from the Federation Account Allocation Committee (FAAC) reveal that South East states collectively generated ₦28.38 billion in Value Added Tax (VAT) during the first quarter of 2025, but received a significantly higher ₦104.5 billion in VAT disbursements.

The data, compiled by economic insights platform Statisense, highlights the revenue redistribution mechanism of the Nigerian federation—where funds are pooled nationally and shared across states based on a formula involving population, landmass, and need.

Breakdown by State:

The figures show that each South East state received far more than it generated, reflecting the federal government’s commitment to balancing regional development through revenue equalization.

Redistribution vs. Regional Autonomy

The disparity between VAT generated and received has long fueled debates about fiscal federalism and resource control, particularly in more economically productive states.

Critics of the current formula argue for state control of VAT, while defenders say the redistribution promotes national equity and helps fund essential services in states with lower commercial activity.

What’s Next?

With the 2027 general elections on the horizon and economic reform debates intensifying, fiscal allocation models like VAT sharing may once again become a key topic of public discourse.